The global trade landscape is an unpredictable and often erratic terrain. Current events are forcing supply chain professionals to navigate a maze of tariffs and tensions while contending with trade barriers that are reshaping established commerce and demanding rapid adaptation. This climate of instability directly affects the intricate networks that underpin modern commerce and, in many ways, shakes the very foundation of supply chain.

As The Wall Street Journal reports, “President Trump’s trade war is forcing America’s closest allies to choose between fighting back or folding. The trouble is, nobody has figured out which tactic works best.”

As the surge in tariffs leads to this ripple effect, established trade flows are in question and businesses are reassessing their sourcing and distribution strategies. From steel and aluminum to automobiles and electronics, the reach is extensive and growing. Here’s a snapshot:

- This week, the U.S. imposed 25% tariffs on global automotive imports.

- Dozens of Chinese companies have been added to a U.S. trade blacklist over national security concerns, escalating tensions between the two nations.

- Tariffs on steel and aluminum imports are having widespread effects on manufacturing.

- Further complexity is being caused by tariffs on goods from Canada and Mexico, with the United States-Mexico-Canada Agreement playing a role in exemptions.

- Tariffs on agricultural products are challenging food supply chains and leading to higher costs for farmers, less market access and price increases for consumers.

Meanwhile, tariffs are looming for copper imports, semiconductors and pharmaceuticals, which would further increase costs for manufacturers reliant on these materials, potentially leading to higher prices for consumers and problems in critical tech and health care supply chains. Plus, as the Trump administration moves forward with reciprocal tariffs, the complexity of the situation only increases.

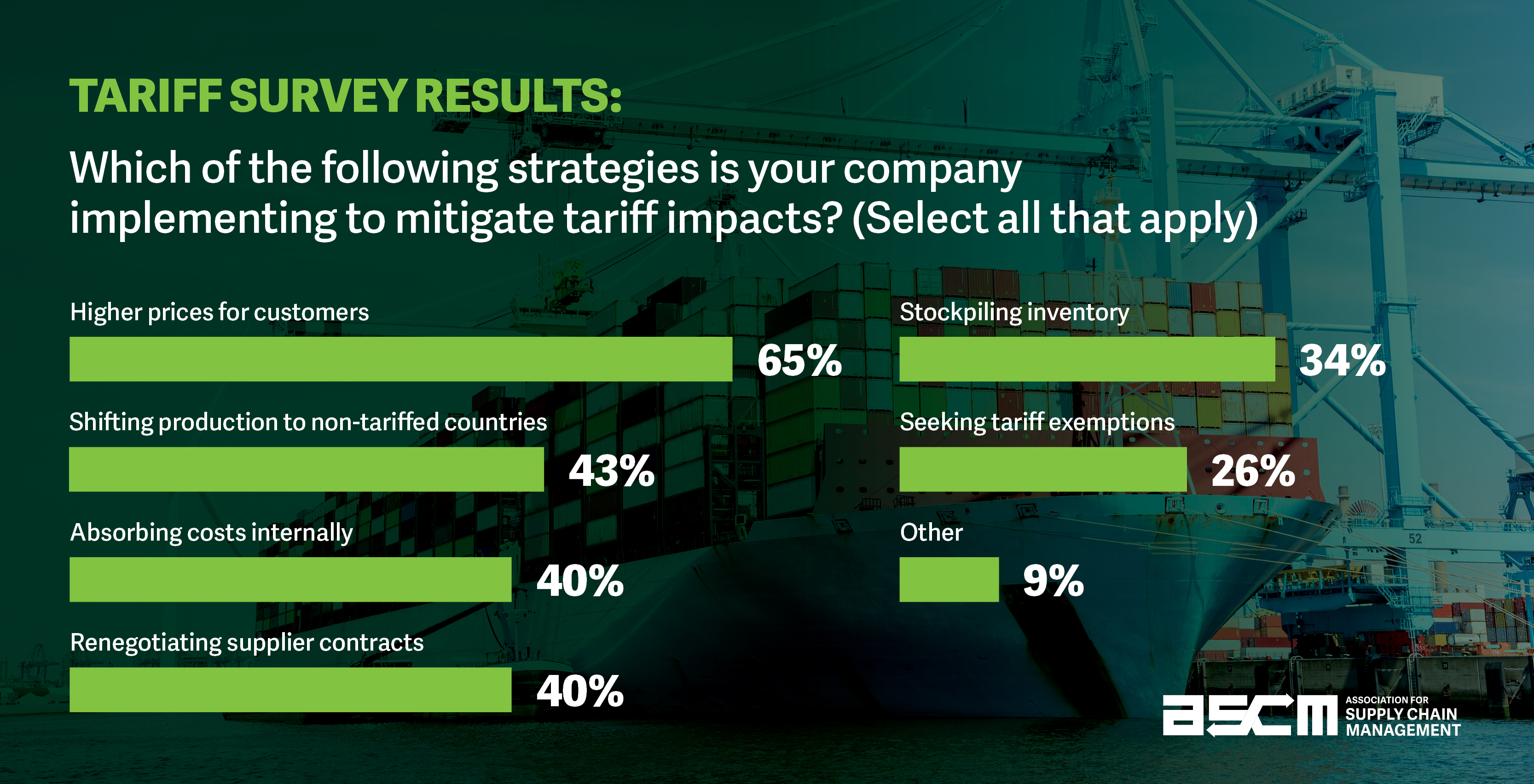

Quoted in today’s Wall Street Journal Logistics Report is a data point from an ASCM survey of 400 supply chain professionals, which revealed that 65% of organizations plan to pass on increased costs to their customers, a move that could lead to dissatisfaction and reduced demand. This hit to consumers is extremely concerning, with 41% planning moderate price hikes, 20% predicting high increases and 3% foreseeing extreme markups.

Beyond passing along costs to customers, the data notes a range of potential tactics, including shifting production to non-tariffed countries (43%), trying to absorb costs internally or renegotiate supplier contracts (40%), and stockpiling inventory in anticipation of further price hikes (34%).

Stay on track with ASCM

As the situation continues to evolve — especially given the administration's frequent policy U-turns — ASCM is committed to empowering you and your team with the latest information. Our brand-new Tariff Tracker is your dedicated resource for understanding key developments and their likely impacts. This valuable resource will feature ASCM's expert analysis alongside a curated news section to help you prepare for disruption and develop effective mitigation strategies. Don't let uncertainty derail your supply chain; head to ASCM's new Tariff Tracker now.